In a turn of recent events, Bangladesh has become the epicentre of an imperial outrage by China after New Dhaka reportedly turned down $5 billion in aid from Beijing. This move has far-reaching consequences, not just in terms of financial straitjackets but national and regional stabilities that are woven around the web of Wdbos link alternatif international relations and economic strategies. The issue, its rejection and the reasons behind it; the implications for Bangladesh and China’s reaction to this along with a broader understanding of internal politics as well as geopolitics.

Historical Context of Bangladesh-China Relations

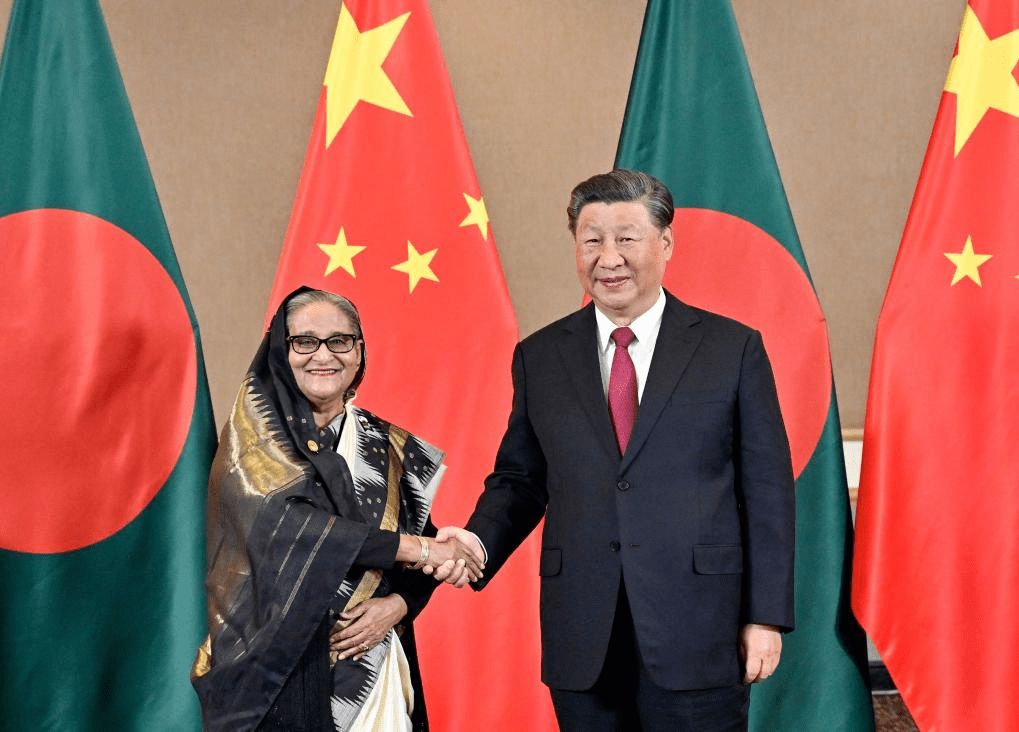

To better appreciate what is happening, the background of Bangladesh-China relations needs to be examined. In recent decades, China has become a key player in South Asia by bringing huge investments and infrastructure projects under its BRI. Bangladesh, being strategically located at the heart of South Asia is one country where China has put in lot of efforts.

There has also been significantly greater economic cooperation, infrastructural development and military support between them. The major supplier of military hardware to Bangladesh is China & has played a crucial role in the development of ports, bridges etc. The two perceived this fledgling relationship as symbiotic, with Bangladesh using Chinese investments to strengthen its infrastructure and China gaining a strategic partner in the region.

The 5 Billion Dollar Loan Proposal

Bangladesh registered the proposal to take a loan of $5 billion from China and this has sparked recent clashes. The loan had been aimed at supporting a raft of major infrastructural developments, with new highways currently being built in addition to bridges and power plants. The country’s strong economic growth – in excess of other similarly impoverished nations — helped make the projects a priority.

But the plans were in limbo after Beijing was said to have attached tough conditions to its loan offer. Standard terms typically saw high interest rates, shorter repayment windows and conditions for Chinese firms to maintain managerial control over the projects. The Bangladeshi government, fearing a debt trap with these terms over the course of history refused and hence things stands at an impasse.

Economic Implications for Bangladesh

The denial in the loan entails a number of economic challenges for Bangladesh. If executed as per envisaged by the government, those plans sooner rather than later would see Zimbabwe transforming its economy from a producer of primary products into an industrial giant; and people will start to walk with their necks high in pride Game Object With Tag. This $5 billion loan was being viewed as the key to these plans.

Unless it gets the loan, Bangladesh could struggle to roll out vital projects that would help grow its economy. Rather, the nation would be forced to turn alternative funding sources that are likely both more expensive and impose other sorts of covenants. Furthermore, the very ambiguity around how these are to be funded could change investor sentiment, thus impacting foreign direct investment (FDI) inflows.

The loan rejection may prove to be a wise move, some analysts say. As Beijing offered terms for the loan some fear would have burdened Bangladesh with unsustainable debt and compromised its ability to determine economic policy. This marks a signal of intent for Bangladesh shade away from short term fixes and begin correlating it into its long-term economic philosophy.

The Reaction from China

China’s reaction to the rejection of the loan has been one of disappointment and concern. The Chinese government has invested heavily in the Belt and Road Initiative, and Bangladesh is a key partner in this strategy. The rejection of the loan could be seen as a setback for China’s ambitions in South Asia.

Chinese officials have expressed their regret over the decision, emphasizing the potential benefits of the proposed projects for Bangladesh. However, they have also stressed the need for mutual respect and understanding in negotiations, suggesting that the door remains open for future cooperation.

This development could prompt China to reassess its approach to lending and investment in South Asia. The growing concerns about debt sustainability and sovereignty among recipient countries might lead China to adopt more flexible and transparent lending practices.

Geopolitical Implications

The rejection of the loan also has significant geopolitical implications. South Asia is a region of intense strategic competition, with India and China vying for influence. Bangladesh’s decision to reject the Chinese loan could be interpreted as a move to balance its relations with both powers.

India, which has historically had close ties with Bangladesh, is likely to welcome this development. New Delhi has been wary of China’s growing influence in its neighborhood and has sought to strengthen its own economic and strategic ties with Dhaka. The rejection of the Chinese loan could provide an opportunity for India to deepen its engagement with Bangladesh.

The United States and other Western powers may also view this development positively. They have been critical of China’s lending practices under the Belt and Road Initiative, accusing Beijing of engaging in “debt-trap diplomacy.” The rejection of the loan by Bangladesh could be seen as a validation of these concerns and might lead to increased Western support for Bangladesh’s development projects.

Bangladesh’s Strategic Calculations

Bangladesh’s decision to reject the loan reflects a nuanced understanding of its strategic interests. While the country has benefited from Chinese investments, it is also aware of the risks associated with excessive dependence on a single country. The rejection of the loan can be seen as an effort to diversify its sources of funding and maintain a balanced foreign policy.

Furthermore, Bangladesh has been keen to assert its economic sovereignty and avoid falling into a debt trap. The experience of other countries, such as Sri Lanka and Pakistan, which have faced debt-related challenges due to Chinese loans, has likely influenced Bangladesh’s decision.

Alternative Funding Sources

In the wake of the rejection of the Chinese loan, Bangladesh is exploring alternative funding sources for its infrastructure projects. The government is in talks with multilateral financial institutions such as the World Bank and the Asian Development Bank (ADB). These institutions are known for their more transparent lending practices and could provide a viable alternative to Chinese loans.

Additionally, Bangladesh is looking to attract more foreign direct investment (FDI) from other countries. The government has been working to improve the business climate, streamline regulations, and offer incentives to foreign investors. These efforts could help attract investment from countries such as Japan, South Korea, and the United States.

The Way Forward

The rejection of the $5 billion loan from China marks a turning point in Bangladesh’s economic and foreign policy. It underscores the country’s commitment to maintaining its economic sovereignty and avoiding unsustainable debt. While the decision poses short-term challenges, it also opens up new opportunities for diversifying funding sources and strengthening ties with other countries.

Moving forward, Bangladesh will need to continue its efforts to attract foreign investment, improve its business environment, and strengthen its economic fundamentals. The government will also need to navigate the complex geopolitical landscape, balancing its relations with major powers such as China, India, and the United States. If you like reading this article then please consider reading our article about India.