Debt relief from India: India and the Maldives share a long-standing and multifaceted relationship that spans across various domains such as trade, defense, and cultural ties. The Maldives, an archipelago nation situated in the Indian Ocean, has historically been in close proximity to India and has relied on its neighbor for economic and strategic support. Over the years, India has emerged as a key economic partner for the Maldives, with bilateral trade and investments contributing significantly to the Maldivian economy.

The relationship between the two countries has been further strengthened by people-to-people interactions, cultural exchanges, and tourism. India has been a popular destination for Maldivian tourists seeking medical treatment, education, and leisure activities. Additionally, India has been instrumental in assisting the Maldives in areas such as infrastructure development, healthcare, and capacity building.

However, the COVID-19 pandemic has significantly impacted the relationship between India and the Maldives, posing unprecedented challenges to protogel both nations’ economies and their ability to support each other during these trying times.

The impact of the COVID-19 pandemic on the Maldivian economy

The Maldives, like many other nations heavily reliant on tourism, has been hit hard by the COVID-19 pandemic. With the closure of borders and travel restrictions, the Maldivian tourism industry, which contributes a substantial portion to the country’s GDP, has come to a standstill. The absence of tourists has resulted in a severe economic downturn, leading to a surge in the country’s debt.

The Maldives’ economy, which heavily depends on revenue generated from tourism-related activities, has witnessed a sharp decline in foreign exchange earnings. This has not only affected the government’s ability to meet its financial obligations but has also exacerbated the unemployment rate and impacted the livelihoods of the Maldivian people.

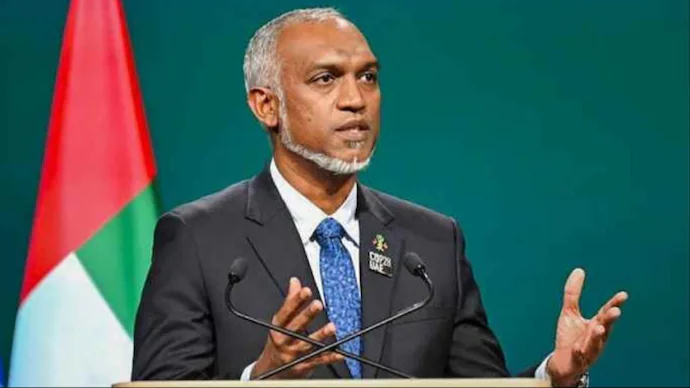

Furthermore, the pandemic has exposed vulnerabilities in the Maldivian economy, highlighting the need for diversification and resilience in the face of external shocks. As the country grapples with the devastating impact of the global health crisis, President Muizzu has turned to India, one of its closest economic partners, in search of debt relief to alleviate the financial strain on the Maldives.

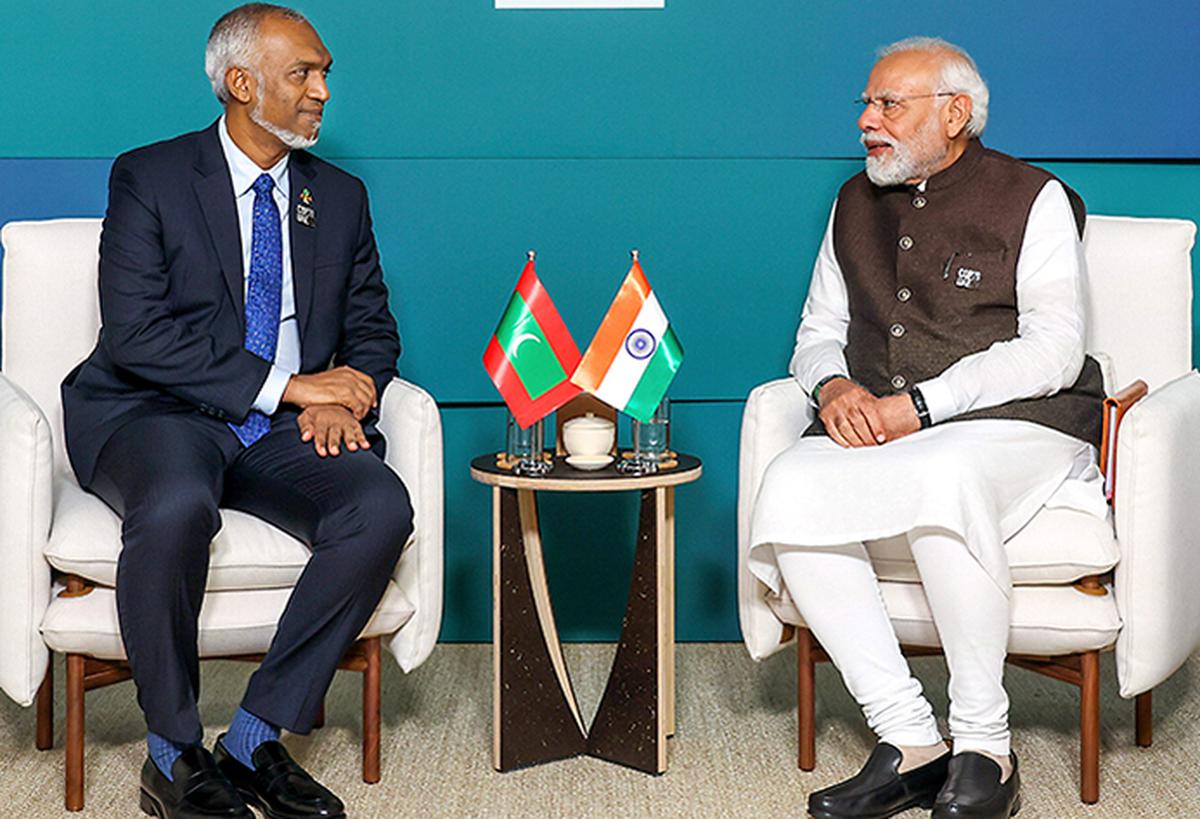

President Muizzu’s plea for debt relief

In a heartfelt plea, President Muizzu has approached the Indian government seeking debt relief for the Maldives. Recognizing the economic challenges faced by his country, President Muizzu has emphasized the importance of India’s support in overcoming these difficulties and ensuring the well-being of the Maldivian people.

The plea for debt relief is a reflection of the Maldives’ dire financial situation, brought about by the closure of borders and the consequential decline in tourism revenue. President Muizzu believes that debt relief from India would provide much-needed breathing space for the Maldives, allowing the government to allocate resources towards healthcare, social welfare, and economic recovery initiatives.

President Muizzu’s appeal for debt relief also highlights the significance of the bilateral relationship between India and the Maldives. As two neighboring nations with shared interests, the cooperation and support extended by India would not only help the Maldives overcome its immediate challenges but also pave the way for long-term economic stability and growth.

Reasons behind the plea for debt relief from India

The plea for debt relief from India is rooted in several factors that have contributed to the Maldives’ current financial predicament. Firstly, the heavy reliance on tourism as the primary source of revenue has made the Maldivian economy particularly vulnerable to external shocks, such as the COVID-19 pandemic. The sudden halt in tourist arrivals has disrupted the country’s revenue streams, exacerbating its debt burden.

Secondly, the Maldives’ high debt-to-GDP ratio has limited its ability to access financial markets and secure alternative sources of funding. With limited options available, seeking debt relief from India has emerged as a viable solution to alleviate the immediate financial strain and regain economic stability.

Additionally, the Maldives’ proximity to India and the strong economic ties between the two nations make India a natural choice for seeking assistance. India’s previous support in infrastructure development projects and capacity building initiatives has established a foundation of trust and collaboration, making it a reliable partner during times of crisis.

Potential benefits of debt relief for the Maldives

Debt relief from India would offer several potential benefits for the Maldives. Firstly, it would provide immediate financial relief and help ease the burden of debt repayments. This, in turn, would free up resources that could be redirected towards critical sectors such as healthcare, education, and infrastructure development.

Moreover, debt relief would enable the Maldives to focus on reviving its tourism industry and attracting tourists back to its pristine beaches and resorts. By investing in marketing campaigns, infrastructure upgrades, and safety measures, the Maldives can position itself as a safe and desirable destination for international travelers, ultimately boosting its revenue and reducing its reliance on external assistance.

Furthermore, debt relief would strengthen the economic partnership between India and the Maldives, fostering closer cooperation and collaboration in various sectors. This could pave the way for joint initiatives and investments that promote sustainable development, job creation, and technology transfer.

Possible challenges in granting debt relief

Granting debt relief to the Maldives poses certain challenges that need to be carefully considered. Firstly, debt relief could set a precedent for other countries facing similar economic challenges to seek assistance. This could strain India’s financial resources and open the door for more requests for debt relief in the future.

Secondly, there is a need to ensure transparency and accountability in the utilization of debt relief funds. It is crucial to have mechanisms in place to monitor the allocation and effective utilization of resources to ensure they are directed towards priority sectors and benefit the Maldivian people.

Additionally, the terms and conditions of the debt relief agreement need to be carefully negotiated to strike a balance between providing immediate relief and ensuring long-term sustainability. It is essential to avoid creating a situation where the Maldives becomes overly reliant on external assistance, hindering its ability to achieve self-sufficiency in the future.

India’s response to the plea for debt relief

India’s response to the plea for debt relief from the Maldives will be closely watched, given the significance of the bilateral relationship between the two countries. As a responsible regional power, India has previously demonstrated its commitment to supporting its neighbors in times of need.

India has already taken steps to assist the Maldives during the pandemic, providing medical supplies, financial aid, and technical expertise. However, the decision to grant debt relief will depend on various factors, including India’s own economic situation, its assessment of the Maldives’ financial needs, and the terms of any potential agreement.

India may consider a combination of debt restructuring, loan moratoriums, and financial assistance to support the Maldives’ recovery efforts. Additionally, India could explore opportunities for increased trade, investments, and collaboration in sectors beyond tourism, such as renewable energy, agriculture, and healthcare, to foster long-term economic stability in the Maldives.

The role of international financial institutions in debt relief negotiations

The involvement of international financial institutions (IFIs) in debt relief negotiations can play a crucial role in ensuring a fair and transparent process. IFIs such as the International Monetary Fund (IMF) and the World Bank have expertise in debt management and can provide valuable guidance and support to both India and the Maldives.

IFIs can help assess the Maldives’ debt sustainability and provide recommendations for a comprehensive debt relief strategy. They can also facilitate dialogue between the Maldives and India, ensuring that the terms of any debt relief agreement are mutually beneficial and aligned with international standards.

Furthermore, IFIs can assist in capacity building and institutional strengthening to enhance the Maldives’ ability to manage its debt and implement sound economic policies. This would contribute to the long-term sustainability of the Maldivian economy and reduce its vulnerability to future crises.

Future prospects for the Maldives’ debt situation

As the Maldives grapples with the economic challenges brought about by the COVID-19 pandemic, President Muizzu’s plea for debt relief from India highlights the importance of international cooperation and support in times of crisis. The Maldives, heavily reliant on tourism, faces an uphill battle in reviving its economy and ensuring the well-being of its citizens.

Debt relief from India would offer immediate financial relief, allowing the Maldives to allocate resources towards critical sectors and revive its tourism industry. It would also strengthen the economic partnership between India and the Maldives, fostering closer collaboration and long-term sustainable development.

However, granting debt relief poses challenges that need to be carefully addressed, such as setting a precedent for future requests and ensuring transparency and accountability in resource allocation. The involvement of international financial institutions can play a vital role in facilitating a fair and transparent debt relief negotiation process. If you found this article insightful and are interested in exploring more delightful topics, we invite you to indulge in our article about Ice Cream Cake. Discover the sweet journey of this beloved dessert and its unique place in culinary history. Your continued interest and curiosity fuel our passion for sharing knowledge across a spectrum of topics.