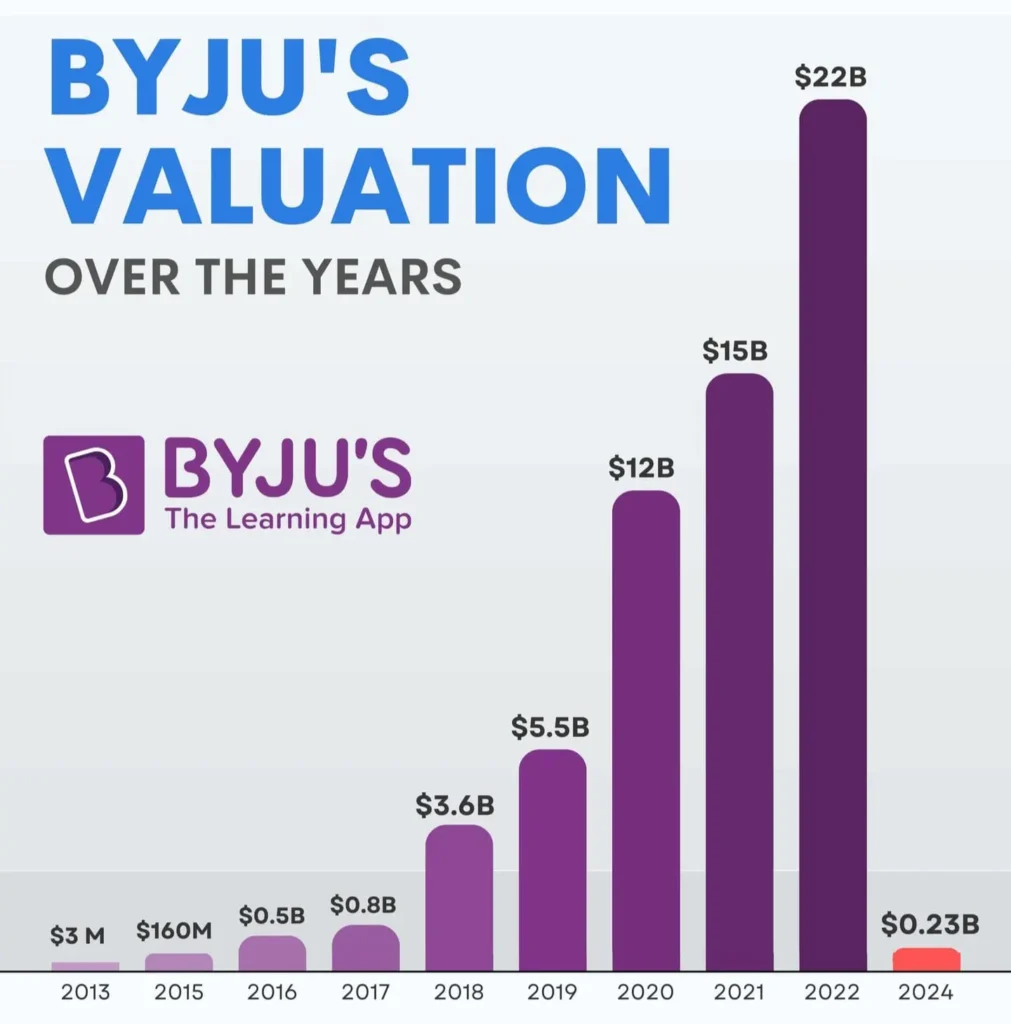

In the cutthroat world of edtech, Byju’s has emerged as a frontrunner, revolutionizing the way students learn with their interactive and engaging online platforms. With a staggering valuation of $16.5 billion in 2020, the Indian startup was hailed as a unicorn, capturing the attention of investors and educators alike. However, recent developments have seen the company’s fortunes take a sharp turn. Reeling from a 99% valuation crash, jpslot Byju’s is now on a quest for survival.

In this article, we delve into the rise and fall of Byju’s, examining the factors that led to its meteoric rise and its subsequent downfall. From its innovative teaching methods to its aggressive marketing strategies, we unravel the secrets behind Byju’s initial success. But we also explore the challenges the company faces today, including intense competition, controversies surrounding data privacy, and the impact of the ongoing pandemic.

Join us as we navigate the tumultuous journey of Byju’s, analyzing the twists and turns that have shaped its destiny and exploring the steps it is taking to stay afloat in an ever-evolving market.

Factors leading to Byju’s valuation crash

Byju’s unprecedented rise in valuation was fueled by a combination of factors. First and foremost, the company’s innovative teaching methods struck a chord with students and parents alike. Byju’s interactive learning app, which combined video lessons with quizzes and personalized feedback, proved to be a game-changer in the education industry. This unique approach to learning attracted a massive user base, contributing significantly to the company’s valuation.

Another key factor in Byju’s success was its aggressive marketing strategies. The company spared no expense in promoting its brand, leveraging endorsements from popular celebrities and investing heavily in advertising campaigns across various media channels. This relentless marketing blitz helped Byju’s gain widespread recognition and establish itself as a leader in the edtech space.

However, despite its initial success, Byju’s valuation crash came as a shock to many. The company’s rapid expansion and aggressive spending eventually caught up with it. Byju focused heavily on customer acquisition, offering steep discounts and free trials to attract new users. While this strategy helped them gain a large user base, it also resulted in mounting losses and a lack of profitability. Investors started to question the sustainability of Byju’s business model, leading to a loss of confidence and the subsequent valuation crash.

The impact of the COVID-19 pandemic on Byju’s

As the world grappled with the COVID-19 pandemic, the education sector witnessed a seismic shift towards online learning. With schools closed and students confined to their homes, the demand for online education platforms skyrocketed. Byju, being one of the key players in the edtech space, initially benefited from this surge in demand. The company experienced a surge in user sign-ups and saw a significant increase in revenue during the early stages of the pandemic.

However, as the pandemic wore on, the challenges for Byju’s started to emerge. With schools and colleges adapting to remote learning, competition in the edtech space intensified. Numerous players entered the market, offering similar services at competitive prices. This increased competition posed a threat to Byju’s market share and put further pressure on the company’s valuation.

Moreover, the pandemic also highlighted certain issues surrounding data privacy and security in the edtech industry. Byju, like many other online learning platforms, collects vast amounts of user data to personalize the learning experience. However, concerns were raised about the extent to which user data was being utilized and protected. These controversies further eroded trust in Byju’s and contributed to the decline in its valuation.

Byju’s response to the valuation crash

In the face of a significant valuation crash, Byju’s was forced to reevaluate its strategies and make necessary adjustments to stay afloat. One of the key steps taken by the company was to focus on profitability and cost optimization. Byju’s reduced its spending on marketing and customer acquisition, instead shifting its focus to improving the quality of its product and enhancing the user experience. This change in approach aimed to build a loyal customer base and ensure long-term sustainability.

Another important move by Byju’s was diversifying its product offerings. Recognizing the need for a comprehensive learning experience, the company expanded beyond its core app and introduced additional features such as live classes, test preparation modules, and career guidance services. Byju aimed to become a one-stop solution for all educational needs, catering to students across different age groups and academic levels.

Furthermore, Byju’s also sought to address the concerns surrounding data privacy and security. The company implemented stricter data protection measures, ensuring that user data was handled responsibly and transparently. Byju’s also engaged in open dialogues with users, addressing their concerns and actively seeking feedback to improve their privacy practices.

Strategies implemented by Byju’s to regain market confidence

To regain the confidence of investors and educators, Byju implemented several strategic initiatives. One such initiative was forging partnerships with educational institutions and governments. Byju’s collaborated with schools and colleges to integrate their platform into the curriculum, thus establishing credibility and fostering trust among educators. Additionally, Byju’s worked closely with governments to provide access to quality education to underserved communities, further strengthening their position as a socially responsible organization.

Byju’s also embarked on an international expansion strategy, targeting markets outside of India. The company recognized the potential for growth in countries with a large student population and an increasing demand for online education. Byju localized its content, adapting it to suit the needs and preferences of different regions. This expansion into new markets not only diversified Byju’s revenue streams but also helped mitigate the impact of intense competition within India.

Furthermore, Byju invested heavily in research and development to stay at the forefront of technological advancements in the edtech industry. By continuously innovating and improving their product offerings, Byju’s aimed to differentiate itself from competitors and provide a superior learning experience to its users.

Lessons learned from Byju’s rise and fall

Byju’s journey provides valuable lessons for both investors and startups in the edtech sector. One of the key takeaways is the importance of sustainable growth. While rapid expansion and user acquisition may seem impressive in the short term, it is crucial to balance growth with profitability. Byju’s over-reliance on customer acquisition discounts ultimately proved unsustainable, leading to financial instability.

Another lesson from Byju experience is the significance of adaptability. In an ever-evolving market, it is essential for companies to be adaptable and responsive to changing dynamics. Byju’s ability to diversify its product offerings and expand internationally highlights the importance of staying ahead of the curve and exploring new opportunities.

Additionally, Byju’s journey underscores the need for responsible data handling practices. As the edtech industry continues to grow, ensuring the privacy and security of user data will be paramount. Companies must prioritize data protection, transparency, and user consent to build trust and maintain a loyal customer base.

The future of Byju’s and the edtech industry

Despite the challenges it has faced, Byju remains a formidable player in the edtech industry. The company’s strategic initiatives, including cost optimization, diversification, and international expansion, position it well for future growth. Byju’s has already made significant inroads into the global market, and with its continued focus on innovation and user experience, it is poised to capture a larger share of the online education market.

The edtech industry as a whole is also expected to thrive in the coming years. The pandemic has accelerated the adoption of online learning, and this trend is likely to persist even after the crisis subsides. With advancements in technology and increasing internet penetration, the demand for accessible and personalized education will continue to rise. As such, investors and startups in the edtech sector can look forward to a promising future.

Competitors in the edtech space

While Byju’s has established itself as a leader in the edtech space, it faces stiff competition from both domestic and international players. One of its main rivals is Khan Academy, a nonprofit organization that offers free educational resources and has gained popularity worldwide. Khan Academy’s emphasis on affordability and accessibility has positioned it as a viable alternative to Byju.

Another major competitor is Udemy, a global marketplace for online courses. Udemy offers a wide range of courses across various subjects and caters to both students and professionals. The platform’s vast library of courses and competitive pricing make it a formidable competitor in the edtech market.

Additionally, global giants such as Coursera and edX also pose a threat to Byju. These platforms partner with leading universities to offer online courses and degrees, providing learners with recognized certifications. With their extensive course catalogs and established brand reputation, Coursera and edX have a significant advantage in the higher education space.

Key takeaways from Byju’s journey

Byju rise and subsequent valuation crash serve as a cautionary tale for startups in the edtech sector. While innovative teaching methods and aggressive marketing strategies can drive initial success, it is essential to balance growth with profitability. Byju experience highlights the importance of sustainable business models and responsible data handling practices in the edtech industry.

However, Byju response to the valuation crash demonstrates its resilience and determination to overcome challenges. By focusing on profitability, diversification, and international expansion, the company has positioned itself for future growth. Byju journey also underscores the immense potential of the edtech industry, which is set to thrive in the coming years.

Investors and startups in the edtech sector should take note of the lessons learned from Byju’s journey. Prioritizing sustainable growth, adaptability, and responsible data practices will be key to long-term success. As the demand for online education continues to rise, the edtech industry presents lucrative opportunities for those willing to navigate the ever-evolving landscape.

Recommendations for investors and startups in the edtech sector

For investors looking to invest in the edtech sector, it is crucial to conduct thorough due diligence and assess the sustainability of a startup’s business model. Evaluating a company’s growth strategy, profitability prospects, and competitive landscape will help make informed investment decisions. Additionally, considering a startup’s approach to data privacy and security is essential to mitigate potential risks.

Startups in the edtech sector should prioritize profitability alongside growth. While customer acquisition is important, it should not come at the expense of long-term sustainability. Finding a balance between revenue generation and user acquisition will be crucial for startups to build a solid foundation for success.

Furthermore, startups should focus on differentiation and innovation to stand out in a crowded market. By offering unique value propositions and constantly improving their product offerings, startups can carve out a niche for themselves and attract a loyal customer base.

Finally, data privacy and security should be at the forefront of every edtech startup’s agenda. Implementing robust data protection measures, being transparent with users, and seeking their consent will help build trust and ensure long-term success.

In conclusion, Byju journey is a testament to the highs and lows of the edtech industry. While its valuation crash was a setback, the company’s response and strategic initiatives demonstrate its resilience and determination to thrive in a competitive market. Byju experience provides valuable lessons for investors and startups in the edtech sector, emphasizing the importance of sustainable growth, adaptability, and responsible data practices. With the edtech industry poised for continued growth, it presents immense opportunities for those willing to navigate the evolving landscape.